India Sees All-Time High Office Leasing By US Companies: What This Means for Global Capability Centres and Professional Services Firms

Published: June 2024 | Author: Han Digital Research Team

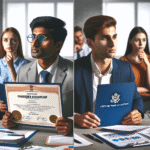

Introduction: India’s Office Leasing Boom Driven by US Companies

India’s commercial real estate sector is experiencing an unprecedented boom, with US-based companies leading the charge in office leasing. According to a recent report featured on MSN, US firms accounted for a record 44% of gross office space leasing in India in the first half of 2024, amounting to approximately 8.8 million square feet. This marks an all-time high, surpassing pre-pandemic levels and signaling India’s growing prominence as a global business hub.

This surge is not just a real estate story—it’s a clear signal of India’s rising strategic importance for Global Capability Centres (GCCs), professional services firms, and multinational corporations seeking to tap into the country’s vast talent pool and cost-effective operational environment.

Key Insights from the Latest Office Leasing Report

- US Companies Lead the Way: US-headquartered firms are the largest contributors to office leasing in India, with a 44% share in H1 2024.

- Focus on Technology and Professional Services: The majority of leased spaces are being used for technology, consulting, and professional services operations.

- Top Cities: Bengaluru, Hyderabad, and Pune remain the most preferred destinations for US companies, owing to their robust infrastructure and deep talent pools.

- Growth in GCCs: The number of GCCs in India has crossed 1,600, with US companies accounting for over 60% of these centres, according to NASSCOM’s 2024 report.

These trends underline India’s critical role in global business strategies, especially for companies looking to establish or expand their offshore and nearshore operations.

Why Are US Companies Leasing More Office Space in India?

Several factors are driving the surge in office leasing by US companies in India:

- Talent Availability: India boasts one of the world’s largest pools of skilled professionals in technology, finance, engineering, and business services. According to McKinsey’s 2024 research, India’s GCCs employ over 1.66 million people, with the number expected to grow by 10% annually.

- Cost Efficiency: Operating costs in India remain significantly lower than in the US and other Western countries, making it an attractive destination for setting up large-scale operations.

- Digital Transformation: The rapid adoption of digital technologies and hybrid work models has increased demand for modern, tech-enabled office spaces.

- Favorable Government Policies: Initiatives such as ‘Make in India’ and incentives for foreign direct investment have created a business-friendly environment.

- Strategic Location: India’s time zone overlaps with both the US and Europe, enabling round-the-clock business operations.

The Impact on Global Capability Centres (GCCs) and Professional Services Firms

The record office leasing activity is a strong indicator of the continued expansion of Global Capability Centres in India. GCCs, often referred to as Global In-house Centres (GICs), are offshore units that provide critical business support functions such as IT, finance, analytics, R&D, and customer service for multinational organizations.

According to the NASSCOM GCC India 2024 report:

- India is home to over 1,600 GCCs, with more than 60% owned by US companies.

- GCCs contributed nearly $46 billion to India’s exports in 2023-24.

- The sector is expected to add 500 new GCCs and create over 700,000 new jobs by 2025.

For professional services firms—including IT, consulting, legal, and financial services—the office leasing boom represents a unique opportunity to scale operations, access top-tier talent, and deliver value-added services to clients globally.

Recent Research: The Future of GCCs in India (2024-2025)

Recent studies highlight several trends shaping the future of GCCs and professional services firms in India:

- Shift to Value-Added Services: GCCs are moving beyond transactional work to focus on innovation, digital transformation, and strategic business outcomes (EY, 2024).

- Rise of AI and Automation: Adoption of artificial intelligence, machine learning, and automation is rapidly transforming business processes, increasing demand for specialized talent.

- Hybrid Work Models: Flexible office spaces and hybrid work arrangements are becoming the norm, driving demand for high-quality, tech-enabled office environments.

- Focus on Sustainability: Companies are prioritizing green buildings and sustainable office practices as part of their ESG commitments.

These trends are accelerating the need for strategic talent acquisition, leadership hiring, and market intelligence—areas where Han Digital offers unparalleled expertise.

Han Digital: Your Strategic Partner for Talent and Leadership in India’s Booming Office Market

As US companies and global professional services firms expand their presence in India, the challenge is no longer just about finding office space—it’s about building high-performing teams and establishing robust leadership pipelines. This is where Han Digital comes in.

Unique Understanding of India’s Talent Markets

With over 15 years of experience in India’s talent ecosystem, Han Digital has developed a deep, data-driven understanding of talent availability, compensation trends, and skill gaps across technology, consulting, and professional services sectors. Our proprietary talent analytics platform provides real-time insights into:

- Talent density across major cities (Bengaluru, Hyderabad, Pune, Chennai, NCR, Mumbai)

- Emerging skills in AI, cloud, cybersecurity, data science, and digital transformation

- Competitor hiring trends and compensation benchmarking

Connections with Senior Leadership

Han Digital’s extensive network with C-suite executives, business leaders, and HR heads in India’s top GCCs and professional services firms enables us to facilitate:

- Leadership hiring for CXO, VP, and Director-level roles

- Succession planning and executive search

- Market entry and expansion strategy consulting

End-to-End Talent Solutions for GCCs and Professional Services Firms

Whether you’re setting up a new GCC, expanding your professional services footprint, or transforming your India operations, Han Digital offers:

- Talent market mapping and location analysis

- Recruitment process outsourcing (RPO) and project hiring

- Employer branding and talent engagement strategies

- Diversity & inclusion consulting

Our consultative approach ensures that your India strategy is aligned with both your business goals and the realities of the local talent market.

Case Study: How Han Digital Helped a US-Based Tech Firm Establish a GCC in India

Challenge: A Fortune 500 US technology company wanted to establish a 1,000-seat GCC in Hyderabad, focusing on AI and cloud engineering. The client needed a rapid ramp-up of skilled talent and strong local leadership.

Solution: Han Digital conducted a comprehensive talent market study, identified key talent clusters, and designed a phased hiring strategy. Leveraging our leadership network, we placed a seasoned India Head and built out the core engineering and product teams within six months.

Results:

- 90% of critical roles filled within target timelines

- Leadership team onboarded with deep India market experience

- Successful launch of the GCC, now a global innovation hub for the client

How to Leverage India’s Office Leasing Boom for Your Business Growth

For US companies and professional services firms, India’s record office leasing activity is more than just a real estate milestone—it’s a strategic opportunity to:

- Access world-class talent at scale

- Drive digital transformation and innovation

- Expand global delivery capabilities

- Enhance operational efficiency and cost savings

- Build resilient, future-ready teams

However, success in India requires more than just office space. It demands a nuanced understanding of talent markets, regulatory frameworks, and cultural dynamics. By partnering with Han Digital, you gain a trusted advisor with the expertise, networks, and insights to help you navigate India’s complex business landscape.

Conclusion: India’s Office Leasing Surge Is Just the Beginning

The all-time high office leasing by US companies in India is a testament to the country’s growing stature as a global business and innovation hub. As GCCs and professional services firms continue to invest in India, the focus will increasingly shift to talent acquisition, leadership development, and organizational transformation.

Han Digital stands ready to support your India growth journey with end-to-end talent solutions, market intelligence, and strategic leadership connections. Whether you’re entering India for the first time or scaling up existing operations, our team is committed to helping you achieve sustainable, long-term success.

Frequently Asked Questions (FAQs)

- 1. Why are US companies increasing office leasing in India?

- US companies are expanding in India due to the availability of skilled talent, cost advantages, favorable government policies, and the country’s strategic location for global operations.

- 2. What are Global Capability Centres (GCCs)?

- GCCs are offshore units of multinational companies that provide business-critical functions such as IT, finance, analytics, and R&D. India is a leading destination for GCCs worldwide.

- 3. How can Han Digital help US companies set up in India?

- Han Digital offers talent market intelligence, leadership hiring, recruitment process outsourcing, and consulting services to help US companies build high-performing teams and establish successful operations in India.

- 4. Which Indian cities are most attractive for office leasing and GCCs?

- Bengaluru, Hyderabad, Pune, Chennai, NCR (Gurgaon/Noida), and Mumbai are the top choices due to their talent pools, infrastructure, and business ecosystems.